Chinese stock market

There are two types of shares in the mainland China stock market, A-shares and B-shares. A-shares are quoted only in renminbi, while B-shares are quoted in foreign currencies, such as the U.S. dollar, and are available to foreign investors on a larger scale. Foreign investors may have difficulties accessing A-shares due to Chinese government regulations, and Chinese investors may have difficulties accessing B-shares, mainly for currency exchange reasons. Some companies choose to list their shares in both the A-share and B-share markets. According to public information, the Wind database serves more than 90% of Chinese financial institutions and 70% of Qualified Foreign Institutional Investors (QFII) operating in China. 中国大陆股市有两种股票,A股和B股。A股仅以人民币报价,而B股则以外币报价,如美国,并向外国投资者提供更大规模的服务。 由于中国政府的监管,外国投资者可能难以获得A股,而中国投资者可能无法获得B股,主要是因为货币兑换的原因。 一些公司选择在A股和B股市场上市。 根据公开信息,Wind数据库服务于90%以上的中国金融机构和70%在中国运营的合格外国机构投资者(QFII)。

For Asset pricing

Against this background, we ask whether, in such a market, technical indicators from collectivistic investment behavior matter more for asset pricing than firm fundamentals.

Cite from: Machine-Learning in the Chinese Stock Market.

government

Therefore, we examine whether return predictability and portfolio performance are compromised for SOEs where government signaling plays such a prominent role.

Given that China has been experiencing a highly dynamic development through a series of structural breaks, implementing various financial reforms, and expanding its capital markets’ openness, we conjecture that highly fiexible methods are required to account for the Chinese market’s specificity.

Cite from: Machine-Learning in the Chinese Stock Market.

retailed investors

Those individual investors are known to be more short-term oriented and trade speculatively, with a contribution of more than 80% of the total trading volume

Cite from: Machine-Learning in the Chinese Stock Market.

Machine Learning

As out-of-sample R^2 has some limitations for model selection, we analyze the models’ conditional predictive ability using a statistical test recently developed in Li, Liao and Quaedvlieg (2020), which allows us to compare the performance of machine learning methods in different macroeconomic environments. (R^2 并不能作为衡量所有机器学习模型的一个普适的指标。Li, Liao, Quaedvlieg 发展出的 方法能够评价机器学习在宏观经济环境中的表现!!!)

We follow the standard approach in the literature for hyperparameters selection, model estimation, and performance evaluation . See, e.g., Gu et al. (2020b) and De Nard et al. (2020).

In particular, we divide our data into three disjoint time periods while maintaining the temporal ordering: the training sample (2000-2008), the validation sample (2009-2011), and the testing sample (2012-2020). The validation sample is used to for optimizing the hyperparameters of our models. The testing sample contains the next twelve months of data right after the validation sample. Meanwhile, both the validation sample and the one-year testing period are kept rolling forward to include the next twelve months.

We use the training sample to estimate the model parameters subject to some pre-specified hyperparameters for a specific machine learning model (我们使用训练样本来估计特定机器学习模型的模型参数,这些参数受一些预先指定的超参数的约束。)

We conjecture that such a difference is due to tree models’ generic properties as they randomly choose a subset of stock characteristics when building decision trees. In this way, predictors like divo, rd, and divi, can become quite influential in some decision trees and thus become more relevant for the whole tree models, while they play a minor role in all other models. (我们推测,这种差异是由于树模型的泛型属性,因为它们在构建决策树时随机选择股票特征的子集。 这样,像divo、rd和divi这样的预测因子可以在一些决策树中变得相当有影响力,从而与整个树模型更加相关, 而它们在所有其他模型中的作用较小。 )

Cite from: Machine-Learning in the Chinese Stock Market.

Predictors Classification

(1) related to market liquidity

(2) related to fundamental factors like valuation ratios (pe, eps, ep, roe)

(3) related to risk measures (特殊回报波动率,总回报波动率,市场beta)

(4) related to trend indicators (如:近期最大回报。)

(5) related speculative behavior (投机行为): abnormal turnover ratio (异常换手率)

(6) industry dummy variables.

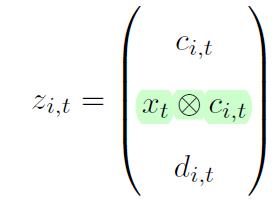

(7) interaction terms between stock-level characteristics and the eleven macroeconomic predictors. Using the Kronecker product:

Cite from: Machine-Learning in the Chinese Stock Market.

Empirical analysis

(1) We start by exploring our models’ prediction performance via out-of-sample predictive R^2 and discuss predictability across different subsamples of our data.

Out-of-sample predictability

- As in Gu et al. (2020b).

如何证明树模型能够检验出 predictors 之间复杂的非线性相互作用 :

- (The distribution of macroeconomic variable importance for tree models GBRT and RF is relatively more uniform than other regression-based methods, indicating these two methods can detect potentially complicated nonlinear interactions between macroeconomic variables and stock characteristics) 与其他基于回归的方法相比,树模型GBRT和RF的宏观经济变量重要性分布相对更加均匀, 表明这两种方法可以检测宏观经济变量和股票特征之间潜在的复杂非线性相互作用.